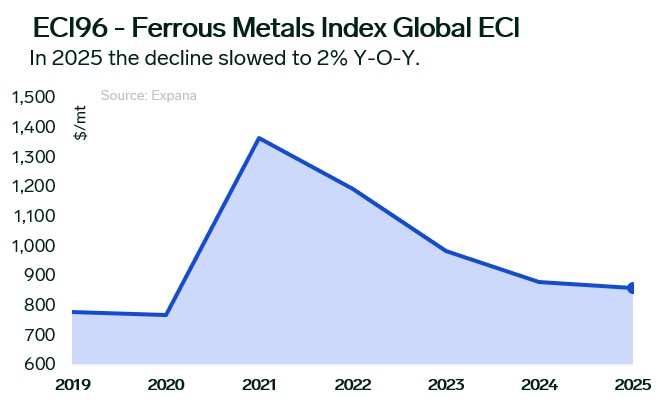

Steel prices exhibited marked regional divergence throughout 2025, shaped by heterogeneous demand fundamentals, trade policy interventions, and currency volatility. European hot-rolled coil (HRC) prices declined 5% year-over-year (Y-O-Y), extending a fourth consecutive annual contraction, although the pace moderated. In US dollar terms, European HRC prices rose 7%, underscoring significant exchange rate movements. US HRC values advanced 9%, driven primarily by sustained 50% import tariffs. Chinese export HRC prices fell 11% Y-O-Y amid a deliberate push to expand shipments in the face of widening trade restrictions.

The dominant headwind remained demand-side weakness. Construction activity across China, the US, and Europe stayed structurally constrained in the second half, reinforcing earlier-year trends. In the US, an October mortgage rate reduction to 6.2% improved home sales but failed to revive permits issuance, suppressing housing starts and steel consumption. European construction confidence deteriorated to negative 5.3 in October, with permit growth decelerating through late summer. By August, construction output growth stalled after several months of 2% to 4% Y-O-Y gains, confirming sectoral cooling. In China, real estate investment contracted sharply, down 15% Y-O-Y through October and 23% in October alone.

Automotive sector performance failed to provide meaningful offset. EU motor vehicle production declined 3.2% Y-O-Y through September. Preliminary US indicators point to September to October contractions, with January to August output down 14% Y-O-Y. China remained the exception, posting 11% Y-O-Y growth in total motor vehicle output for the first ten months, including a 28% Y-O-Y surge in electric vehicles. Nevertheless, automotive gains were insufficient to counterbalance construction-led demand erosion.

Globally, raw material input costs fell, supporting margins. Iron ore prices contracted 4%, coking coal declined 26%, and steel scrap decreased 8% Y-O-Y. Fourth-quarter trends diverged. Chinese steel output reductions cut import ore demand, exerting downward price pressure, while European and US producers increased reliance on scrap feedstock, leveraging both cost efficiency and lower carbon intensity. Turkey’s role as the largest steel scrap importer reflects a structural trade-off between scrap imports for remelting and semi-finished steel imports from China for rerolling. These dynamics suggest ceiling effects on scrap demand growth and potential cost transference to semi-finished products.

Global crude steel production slipped 2% Y-O-Y through October under weaker demand and capacity curtailment. India led growth, expanding output 10% Y-O-Y on robust domestic consumption. US crude steel production rose 3% Y-O-Y, propelled by import substitution from tariff barriers and the planned year-end restart of US Steel’s Granite City Works blast furnace, adding 1.2 million tons of capacity idled since 2023. In contrast, China cut domestic output while increasing exports 7% Y-O-Y, predominantly semi-finished products, to navigate rising protective duties on finished steel.

Europe’s market is undergoing strategic realignment under the Carbon Border Adjustment Mechanism (CBAM). CBAM applies Emissions Trading System (ETS) linked carbon costs, currently €60 to €80 per ton, to imports, harmonizing conditions with domestic producers while penalizing high-emission steel. Indian-origin steel, with emissions over twice the EU average, faces significant surcharges. Technology mix is now pivotal under CBAM. Basic oxygen furnace (BOF) processes emit roughly 2 tons CO₂ per ton of steel, whereas electric arc furnace (EAF) production emits 0.15 to 0.4 tons, conferring a competitive advantage to low-emission producers.

Looking ahead to 2026, structural trajectories in construction across key consuming regions and persistent domestic demand softness will be decisive. Trade policy measures will continue reconfiguring supply flows as US tariff protection endures and EU CBAM implementation enters full force. Competitive positioning will hinge on Chinese semi-finished export dynamics and European scrap market pricing, with implications for global steel production cost structures.

Image source: Adobe

Written by Artem Segen