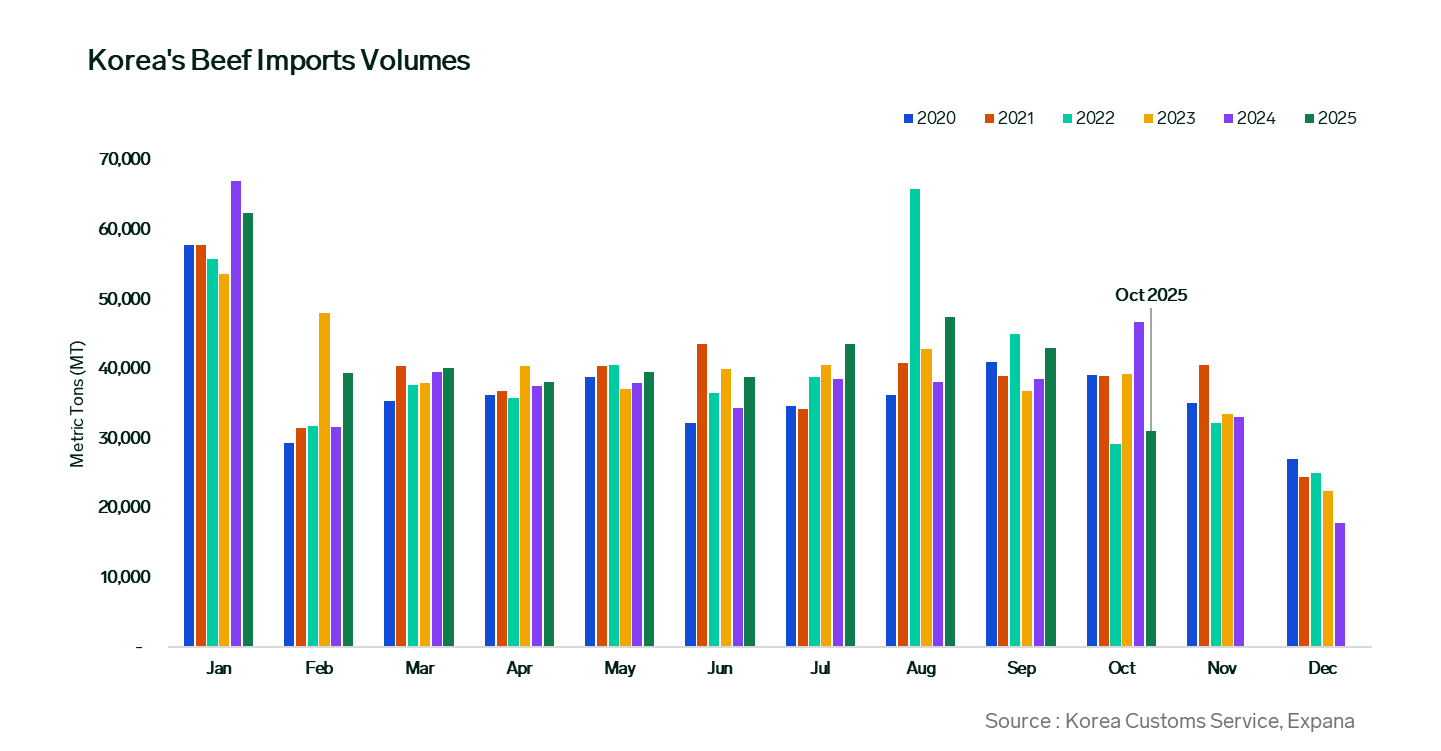

Korea’s beef imports in October 2025 slumped 27.9% compared to the prior month to 31,068 metric tons (mt), according to data from the Korea Customs Service.

Falling 11,996 mt, the activation of Special Agricultural Safeguards (SSG) back in September 12 on Australian beef was the main factor behind the drop in volumes. On a year-on-year (YOY) basis, volumes also fell 33.5% or 15,628 mt.

Until 31 December 2025, beef imports from Australia faced an ad-valorem Most Favored Nations (MFN) rate of 24.0%. Importers are limiting shipments to essential volumes and prefer to target deliveries in the new quota year, when the in-quota tariff rate will ease by 2.7 percentage points to 5.3%.

Reduced US production and higher price points further limited shipments, while an extended Chuseok holiday compressed product inflows, compounding the month’s downturn.

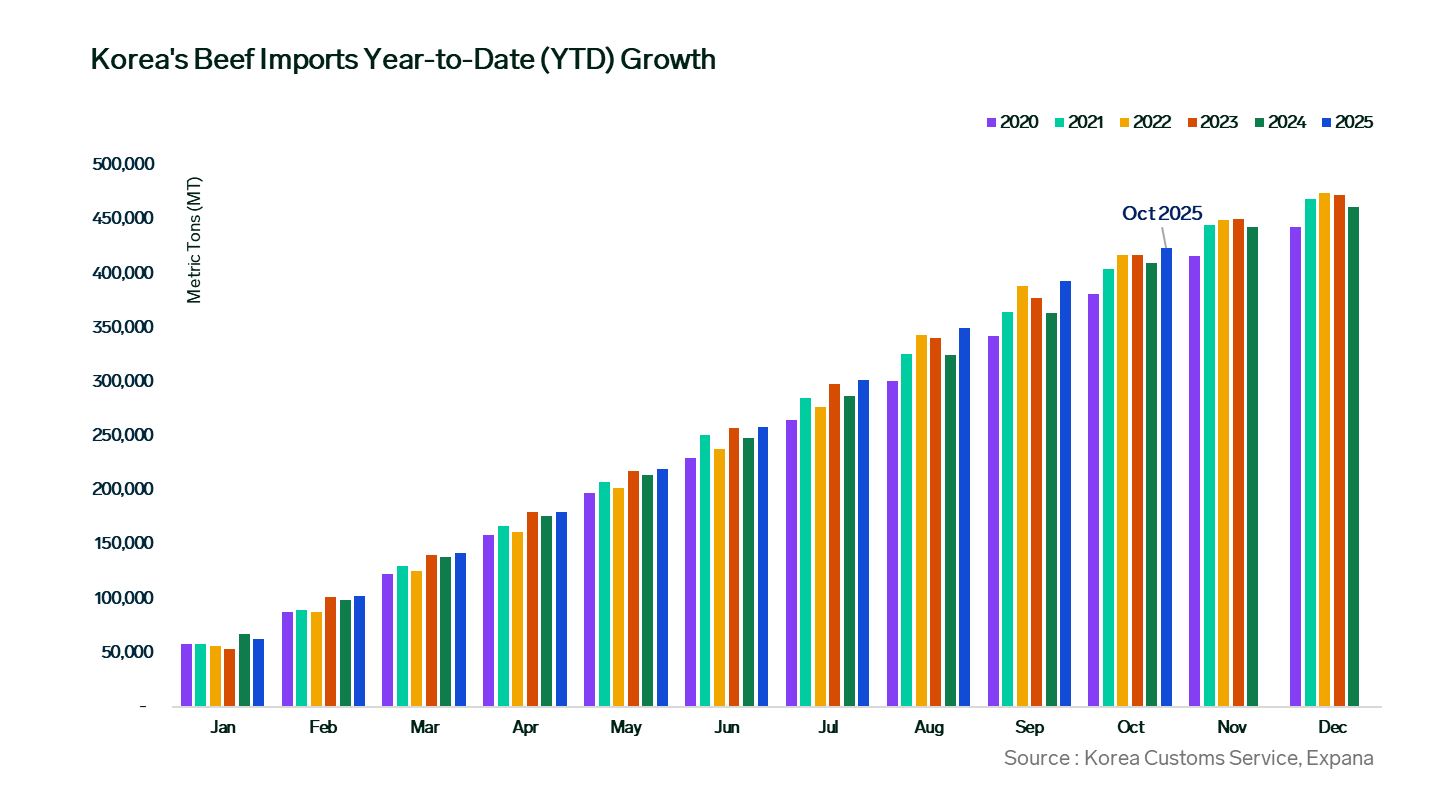

Despite ongoing political tensions and a sluggish economy, year-to-date (YTD) beef imports in one of Asia’s largest markets reached 423,673 mt, up 3.3% (+13,579 mt).

The growth was supported by reduced domestic Hanwoo production and the peninsula’s “livelihood recovery consumption coupon” program, launched July 21, which boosted wider beef demand.

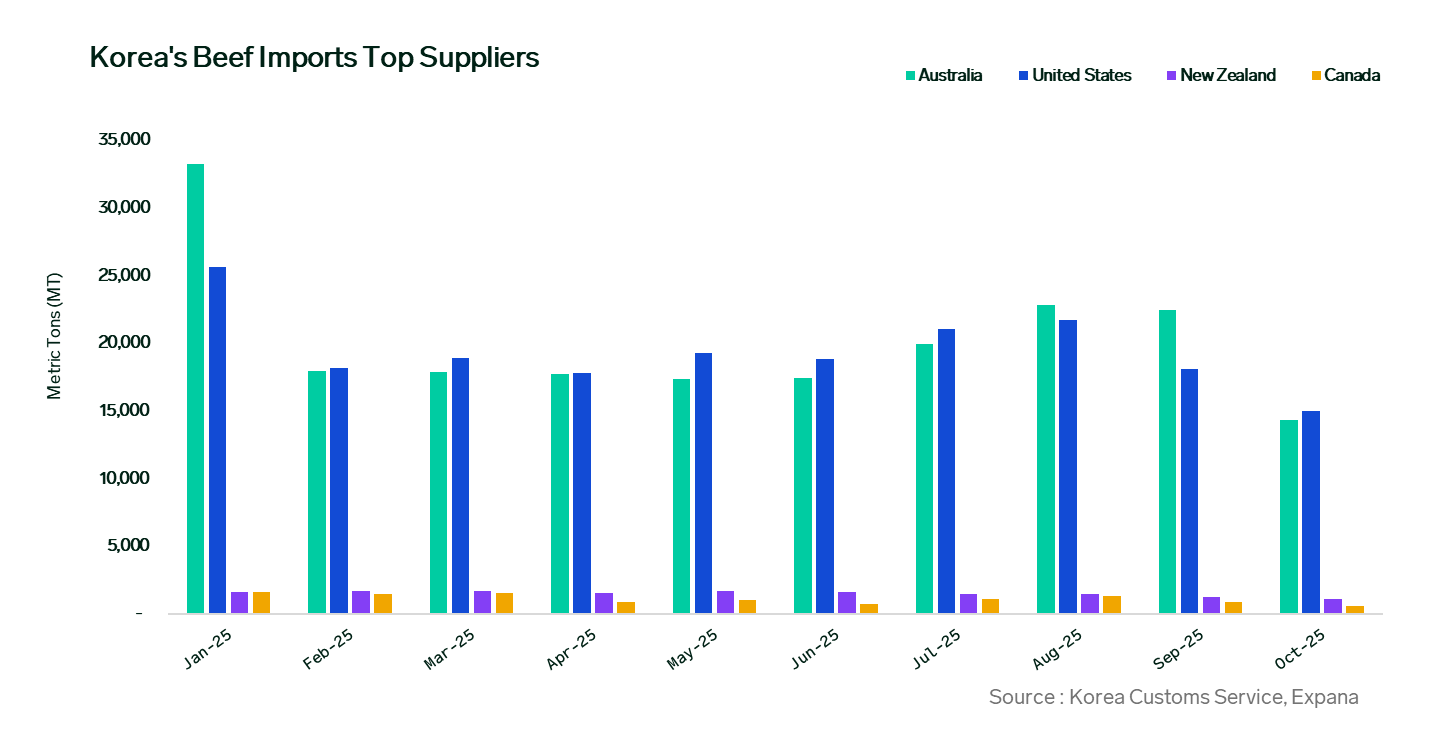

Key Supplier’s Breakdown by Volume:

The United States

With a market share of 48.2%, US beef imports overtook Australia’s top spot, but volumes in October 2025 fell again for the second month since August’s seven-month high.

Inbound tonnage dropped another 17.0% MOM (-3,072 mt) to 14,975 mt, as higher prices driven by limited US production prompted buyers to curb excessive inventory buildup.

On a yearly basis, volumes similarly shed 27.3% (-5,619 mt).

Australia

With volume plunging to an 11-month low, Australia held a 46.0% market share with 14,300 mt.

Volumes plunged 36.4% MOM (-14,300 mt) on the back of Korea’s activation of its safeguard mechanism back in mid-September. On a yearly basis, volumes similarly fell 37.5% (-8,593 mt).

Shortfalls in US supply pushed buyers toward Australian beef, while TV ads and celebrity endorsements lifted demand, driving YTD growth up 7.2%.

Other notable suppliers to Korea in October 2025 were New Zealand with 1,113 mt and Canada with 536 mt.

Co-authored by:

Joe Muldowney

Expana

1-732-240-5330 ext. 244

[email protected]

Bill Smith

Expana

1-732-240-5330 ext. 265

[email protected]

Image source: Getty

Written by Junie Lin