Argentina’s shrimp exports remain under pressure despite strong seasonal sales in September and October.

November volumes fell 34.8% year‑on‑year, according to the Argentinian National Institute of Statistics, leaving the January–November year‑to‑date volume down 22.0% and export value down 12.0% in USD. Disruptions since March — notably strikes in the sea‑frozen fishing sector tied to broader social unrest — have impacted monthly shipments: every month this year stands below 2024 levels except April, which was flat.

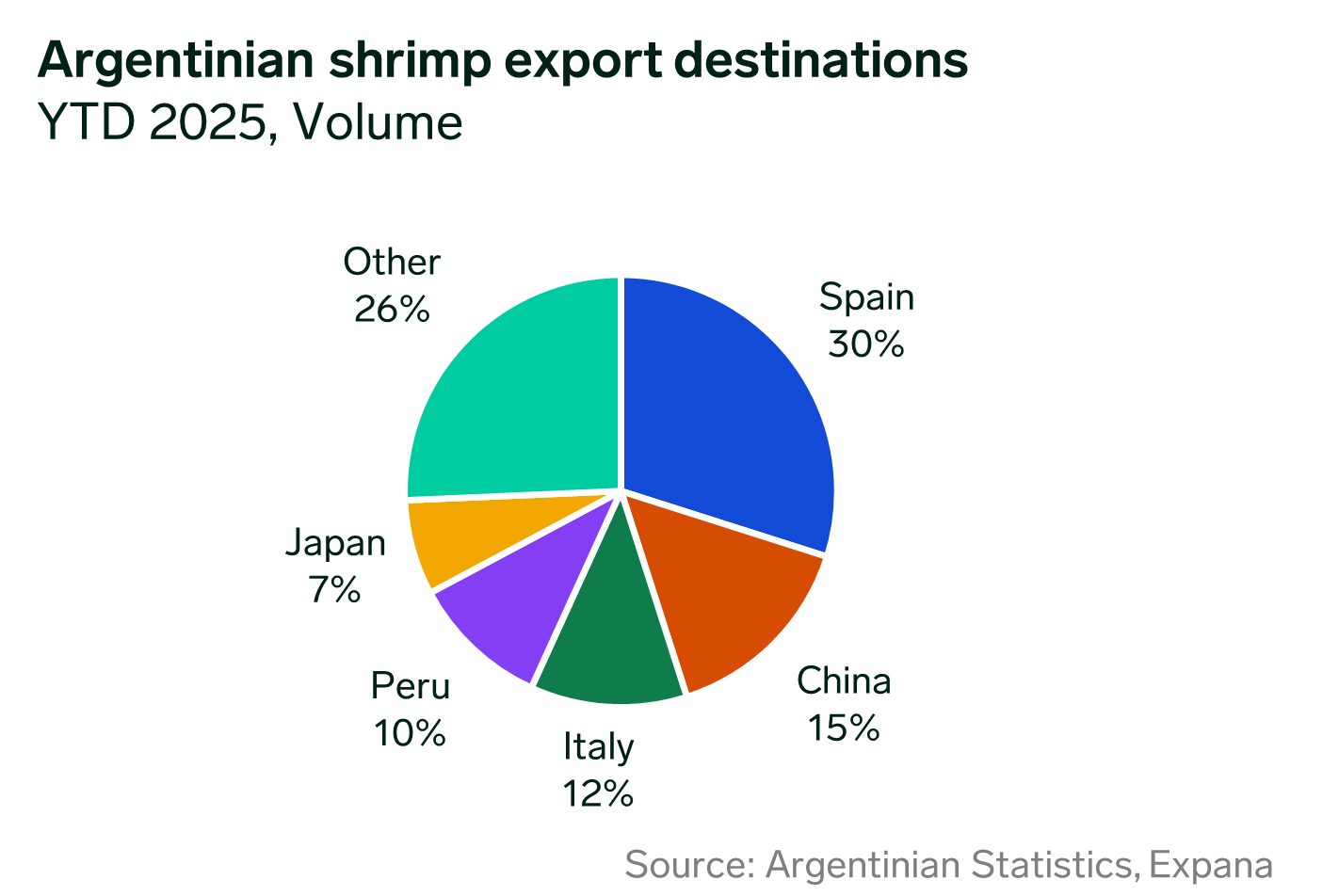

Year-to-date, Argentina exported 111,581 MT of wild shrimp, worth around USD 807.6 million, but destination patterns have shifted.

Spain, which accounted for 37% of Argentina’s shrimp volume in Jan–Nov 2024, has reduced container imports by 36.4% and now holds a 30% share. Italy’s volumes fell 39.8%, dropping it to third place behind China. China’s decline was more modest at 3.0%, representing 15% of Argentina’s shrimp exports this year. Exports to Japan plunged 34.8%, leaving Japan with a 7% share versus 9% a year earlier. By contrast, several smaller Asian buyers increased purchases: Vietnam (+27.7%), Thailand (+15.8%) and Indonesia (+31.1%). Overall, Asia now receives 32.6% of Argentine shrimp exports, while the EU–UK accounts for 42.9%.

Despite the downturn, local contacts are cautiously optimistic for the incoming year. Many processors and exporters of wild shrimp have recently secured MSC certification, which should broaden market access for Pleoticus muelleri (Argentine red shrimp) and support export recovery.

Written by Fabienne O'Donoghue