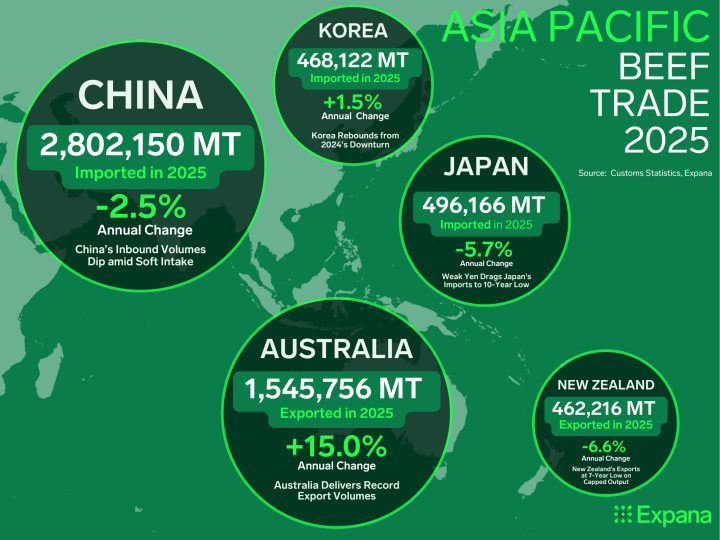

Asia’s beef trade in 2025 showed sharper shifts and clearer winners than a year earlier, as changes in demand, currency volatility, and policy moves redirected flows across the Asia Pacific.

Buyers leaned more heavily on Australian and New Zealand supply, while weaker regional currencies and rising staple food costs squeezed household protein budgets in key importing markets, pushing imports and consumption to multi year lows.

These forces hastened the reallocation of shipments and tightened availability in parts of the region, while fresh policy settings set the stage for a more contested trade environment in 2026.

In this analysis, we examine the trends that shaped 2025 and what they signal for the region’s beef markets in the months ahead for 2026.

2025 At A GLANCE

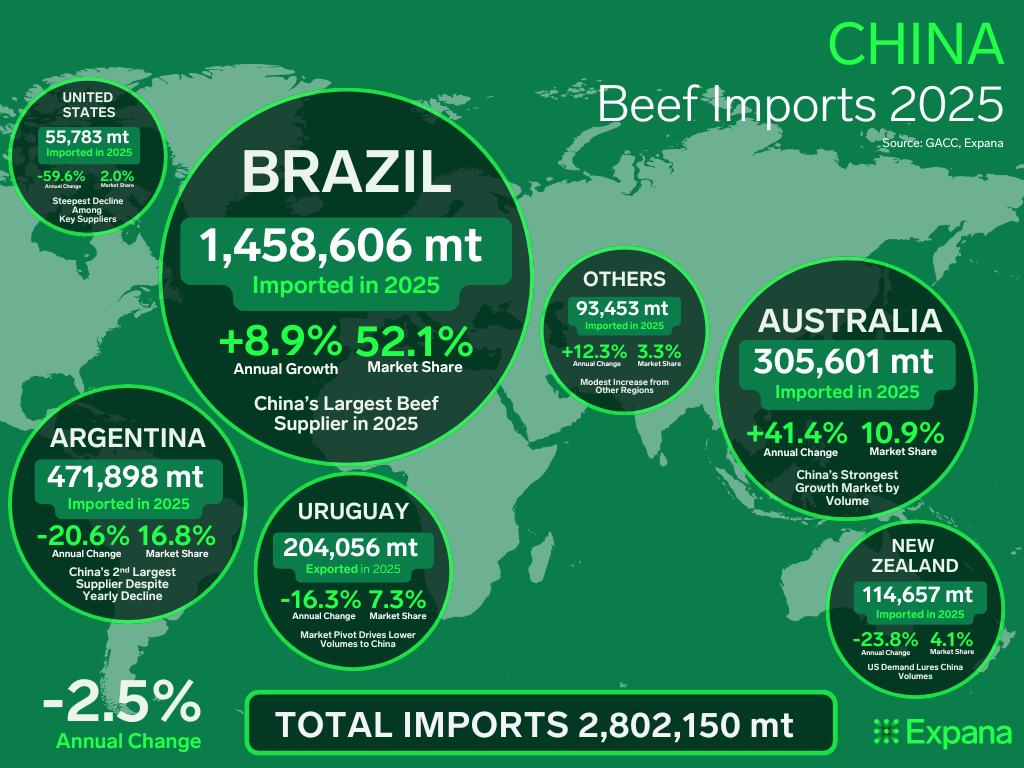

China

Despite holding its position as the world’s largest beef importer since 2019, China’s beef consumption remained under pressure amid a prolonged cost of living squeeze.

Total beef imports in 2025 slipped 2.5% from a year earlier, although September broke the pattern with a record 315,886 metric tons (MT) of arrivals. Shipments from the Mercosur bloc including Brazil, Argentina, and Uruguay delivered mixed outcomes, while Australian volumes recorded the largest annual increase.

As the country’s highest priced mainstream livestock protein, beef faced headwinds from a weakened economy that pushed consumers to cut back, reinforcing its secondary role to pork in the domestic diet. Falling pork prices further eroded beef’s competitiveness, adding to pressure on consumption across the market.

Demand was also dampened by growing backlash against industrially processed pre-made meals known as “yuzhicai”, as concerns over freshness and food safety spread. The pullback was most evident in everyday commodity segments during 2025.

From Q4 2025, the placement of most suppliers on China’s “Enhanced Supervision List” sharply curtailed imports. Lengthy customs clearance times lifted port and service costs, tightening logistics and slowing shipment flows.

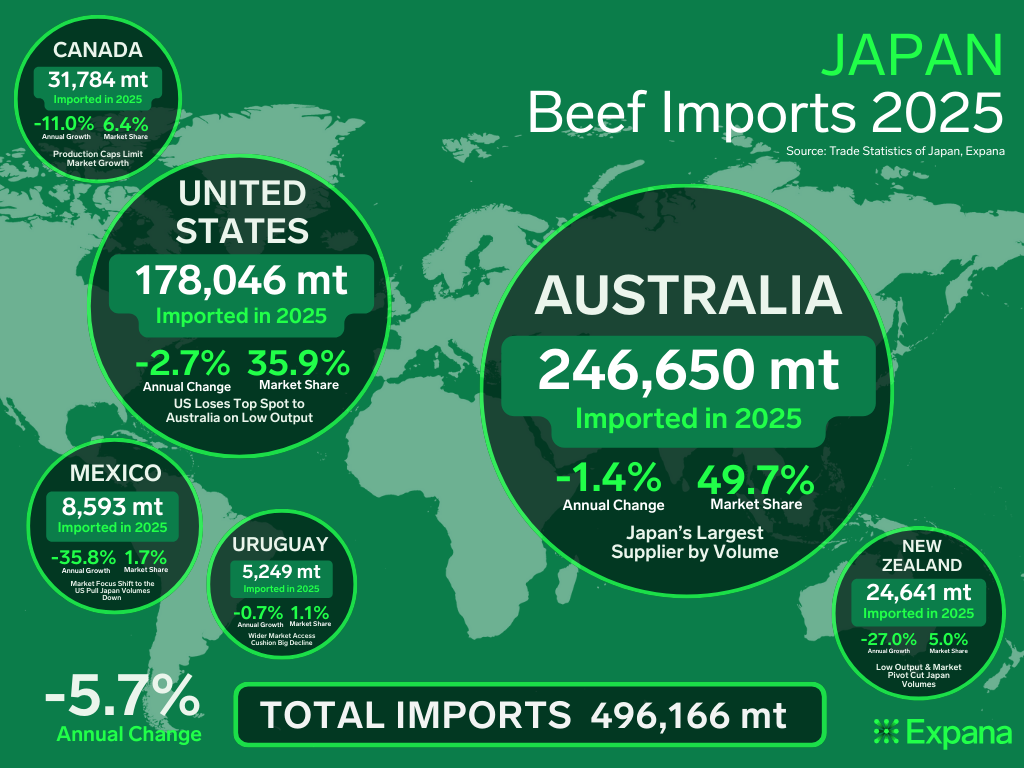

Japan

Japan’s total beef imports in 2025 plunged to their lowest level in a decade. Inbound volumes fell below 500,000 MT for the first time since 2015 as broader economic pressures and shifting consumer priorities hit the market.

Importers struggled with higher yen-denominated costs amid a weak currency and rising global beef prices, while climbing staple food costs, including rice and vegetables, further squeezed household protein budgets.

The impact on consumption was stark, with beef intake dropping to a 23-year low in February 2025, falling to just 134 grams per capita, according to data from the Agriculture & Livestock Industries Corporation (ALIC).

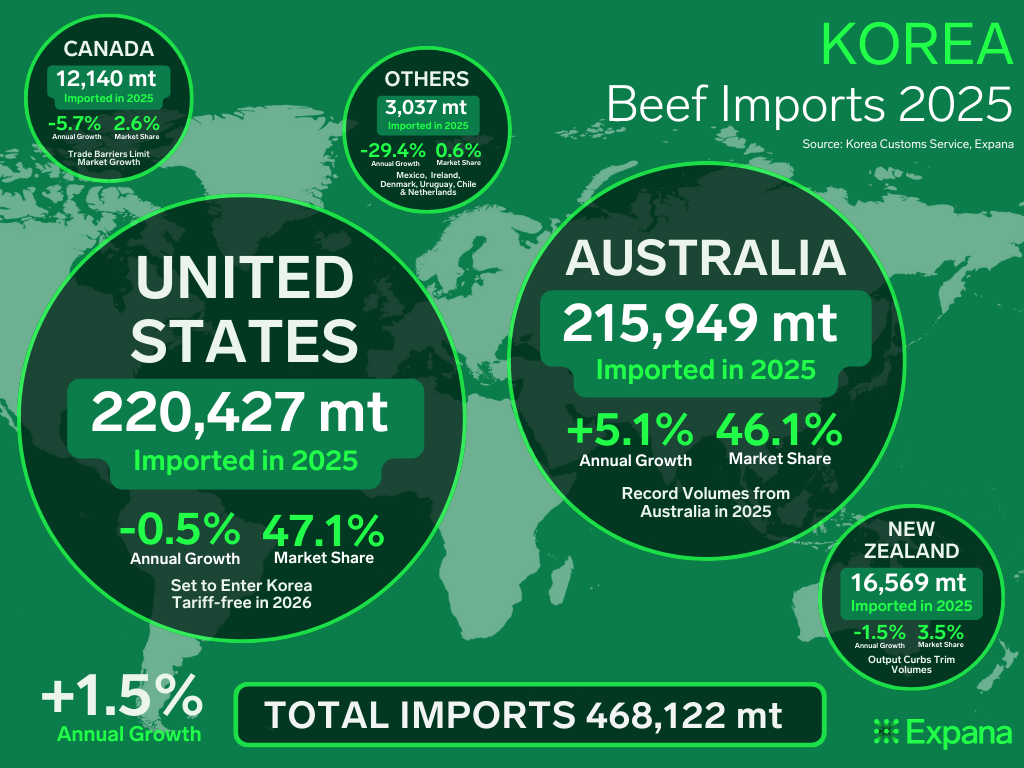

Korea

In 2025, the world’s fourth-largest beef importer reversed its 2024 slump with annual imports rising by 1.5% from a year ago.

The recovery was driven by weaker domestic Hanwoo production and a demand boost from the government’s “livelihood recovery consumption coupon” program, launched on July 21, which lifted household beef purchases.

Tightening US production reduced available volumes, sending US-origin shipments to the lowest level since 2018.

That shortfall opened space for Australian exporters, which recorded their largest shipments to Korea on record.

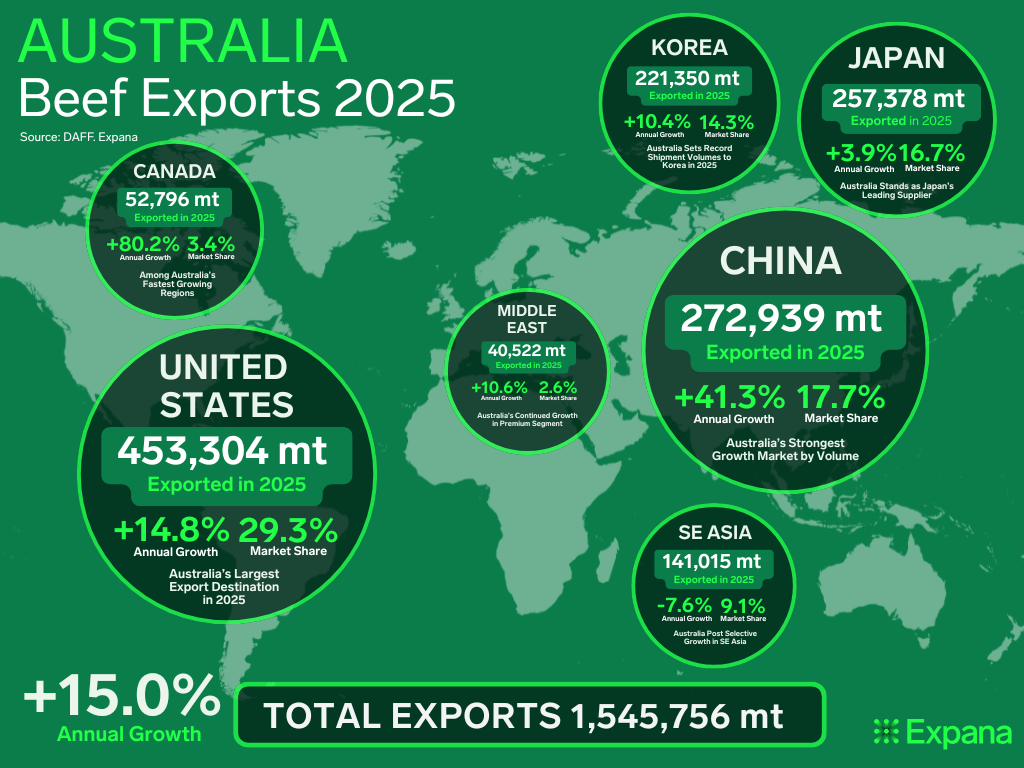

Australia

Australia capitalized on the United States (US) multi decade herd lows to lift shipments to the world’s largest beef market, with the US becoming its top export destination in 2025. Adjustments to White House tariffs did little to curb demand from the 340.1 million strong consumer base with its insatiable appetite for burgers.

Ample domestic production enabled Australia to capture additional market share through 2025, even as global trade conditions remained pressured.

Separately, the US/China trade dispute accelerated growth in Australian grain fed beef shipments to China, which became the country’s fastest growing market by volume during the year.

Tighter US supply also pushed Japan and Korea to lean more heavily on Australian beef, reinforcing its role as a key supplier across Northeast Asia.

New Zealand

Marking a seven-year low, New Zealand’s 2025 total beef exports (customer access only) fell to the lowest level since 2018.

Elevated cattle retention limited supply through the year, as stronger dairy demand and high cattle prices curtailed slaughter and restrained beef output, dragging on export availability.

Most major destinations recorded declines, although the US and China continued to absorb the bulk of shipments. Sales to the US were restricted from Q2 through mid Q4, after a 15% tariff under the Fair and Reciprocal Plan took effect in July and was not lifted until mid-November 2025. Shipments to China softened amid sluggish consumption and intense competition from South American grassfed beef.

In contrast, exports to Canada and the United Kingdom rose sharply, underpinned by firmer returns and resilient demand.

Brazil

When it comes to Asia Pacific beef trade, Brazil’s footprint is too large to overlook.

The South American giant ended 2025 with record beef export volumes, especially China reinforcing its status as the world’s most dominant supplier despite tougher trade conditions.

Strong production underpinned its export capacity, while competitive pricing kept Brazilian beef at the core of China’s import mix, even as buyers turned more cautious and selective over the year. Tighter customs checks and longer clearance times in Q4 2025 added logistical friction but stopped short of materially disrupting trade.

Market Watch Points for 2026

Beef trade in Asia Pacific in 2026 will largely revolve around one factor — how China’s new safeguard policy plays out.

Imposed since January 1, imports exceeding allocated quotas face a steep 55% tariff, sharply curbing volumes from affected origins. The high levy makes it likely that shipments will taper sharply once quotas are filled, with Brazil and Australia among the most exposed.

On the supply side, American beef could flow back into Chinese kitchens and restaurants if lapsed permits are renewed, with Canada and Ireland now joining the ranks of approved plants.

However, China is likely to stay a tough market, as sluggish demand is weighed down by the cost-of-living squeeze and a deepening property crisis that erodes household wealth. As the most expensive animal protein, market movements in pork and chicken will also influence overall beef demand in China for 2026.

Even so, China’s new safeguard policy gives New Zealand a wide window, with a quota nearly double last year’s shipment.

As Australia’s allowances tighten, Chinese buyers are increasingly turning to New Zealand, and the second half of 2026 might see prompt stronger sales. Industry reports showed that 28% of Australia’s 205,000 metric tons (MT) quota had already been used by the end of January, hinting that the quota could be exhausted much sooner than expected.

Despite this advantage, New Zealand’s supply remains curtailed. It’s mostly grass-fed beef production is expected to remain low in 2026 as cattle kills stay constrained. Abundant pastures, ample rains and strong milk prices are encouraging farmers to hold cows longer, limiting slaughter and capping overall output.

Japan is likely to remain a challenging market for imported beef in 2026. Displaced volumes from China’s exhausted quota may allow Australia to lift shipments to Japan. But the yen’s weakness is still likely to weigh on landed costs.

Industry strategists forecast the currency could fall to 160 per dollar or lower by year-end, while fiscal-driven inflation risks threaten distributor margins. Demand growing in Korea, along with demand growth in Southeast Asian, Middle Eastern, and United Kingdom (UK) markets, will still require Japan to compete on price.

Korea’s beef demand is expected to remain resilient, supported by rising per capita consumption and stronger interest in home meal replacement and ready-to-heat products. Domestic Hanwoo output is likely to stay limited amid ongoing herd rebuilding, underpinning import demand.

Post-event sentiment from Gulfood 2026 highlighted the Middle East as a growing outlet for Australian beef, particularly grain-fed volumes once China’s safeguard quota is exhausted. Proponents noted that certain cuts and specifications work well for the region, though they aren’t a one-to-one replacement for displaced Chinese volumes.

Competition in the Middle East is still expected to pick up over the coming months, particularly for Australian beef. Still, most of the volumes displaced by China’s safeguard quotas are likely to head to Japan and Korea, where US supply remains tight and established seller-client relationships are stronger.

Across Southeast Asia, trade is expected to remain constrained in key growth market Indonesia unless changes are made to its uneven allocation of import permits. Its government cut private-sector beef quotas from 180,000 MT to 30,000 MT, reallocating the remainder to state-owned enterprises (SOEs).

Other markets in the region, including Indonesia, the Philippines, Thailand, and Vietnam, are expected to see moderate growth, driven by rising tourism and expanding middle classes that are supporting stronger protein demand.

China’s safeguard policy has added a clear twist to the market, but key producers and exporters, including Australia and New Zealand, will still be chasing destinations with stronger netbacks, particularly the US. Trade to the US is expected to remain broadly supportive for both countries in 2026 despite past temporary tariff hikes and ongoing global political tensions.

The US cattle herd fell to its smallest size since 1951, with 86.2 million cattle and calves as of January 1, according to the USDA’s biannual report, while new dietary guidelines supported beef demand, underpinning stronger domestic consumption. Meanwhile, Brazil is expected to balance its export momentum throughout 2026, with China’s safeguards limiting volumes and a shift in the cattle cycle likely to slow production growth in the second half of the year, as the country focuses on diversifying exports to other growing markets.

All eyes are now on Brazil’s pending entry into the Japanese market, the world’s second-largest beef importer, which could pressure Australia and New Zealand’s competitive position among grassfed suppliers, particularly in price-sensitive segments.

Co-authored by:

Augusto Eto

Expana

+55 41 99949-9700

[email protected]

Joe Muldowney

Expana

1-732-240-5330 ext. 244

[email protected]

Bill Smith

Expana

732-575-1977

[email protected]

Image source: Getty

Written by Junie Lin