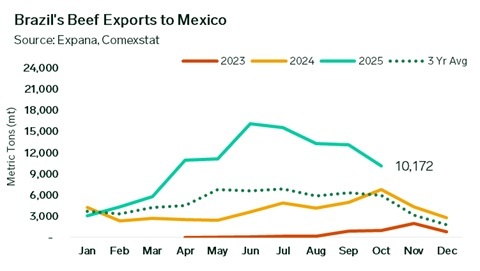

Brazil’s beef exports to Mexico moved lower in October, as participants reported being adequately covered for both short- and medium-term needs, reducing the urgency for additional bookings. Some participants had maintained a more cautious stance while the industry awaited the decision on the PACIC renewal, which was finally confirmed this week. The announcement removed a point of uncertainty, although participants indicated that it is still too early to determine whether the extension will materially influence short-term import activity.

The PACIC was originally introduced in May 2022 as a government initiative to contain inflation by reducing or eliminating tariffs on key food and animal-protein products. It was reinforced later that same year and has been renewed several times since, with each extension preserving tariff exemptions that have supported the flow of imported beef. Over time, these renewals have contributed to steady interest in Brazilian product, offering buyers an alternative during periods of tighter domestic supply.

Domestic supply conditions in Mexico have remained tight, with stricter movement protocols related to the New World Screwworm and reduced inflows of Central American cattle limiting the availability of feeder and slaughter animals. These constraints have sustained demand for Brazilian material, as buyers have continued to rely on imported product to manage supply needs amid elevated domestic cattle prices.

Even so, October volumes reflected a more moderated import rhythm as buyers balanced existing coverage in the weeks prior to the PACIC renewal. Participants also noted that any future adjustments to US tariff policy could influence regional demand and potentially affect the availability of imported product. In practical terms, if US demand for Brazilian material were to increase, it could place upward pressure on prices and tighten the supply directed to Mexico.

Image source: Getty

Written by Jaime Almeida