Scottish Atlantic Salmon Production

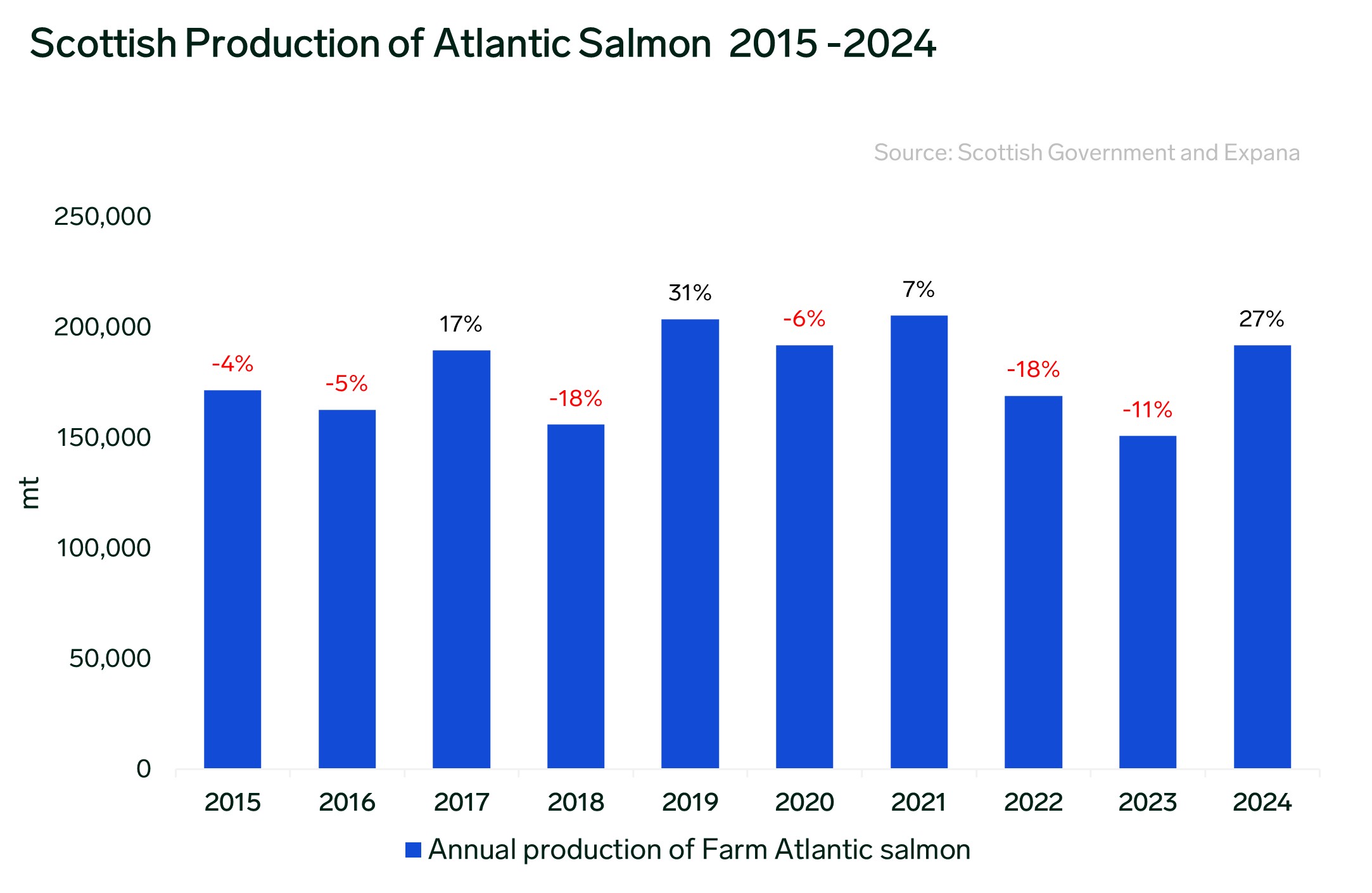

The Scottish Fish Farm Production Survey 2024, published in October 2025, reported a notable increase in Atlantic salmon production in 2024, reaching 192,000 metric tonnes (mt), up 41,051mt (+27%) year-on-year (y-o-y). Current estimates for 2025 production are approximately 195,182 mt, a further 1.7% increase y-o-y. Salmon production in Scotland has been volatile over the past decade (Figure 1), but if the 2025 forecast is met, this will mark two consecutive years of growth.

Figure 1: Annual farmed Atlantic salmon production in Scotland from 2015 to 2024, measured in metric tons, along with the corresponding yearly changes in volume. Source: Scottish Fish Farm Production Survey 2024.

Scottish Farmed Atlantic Salmon Health Performance

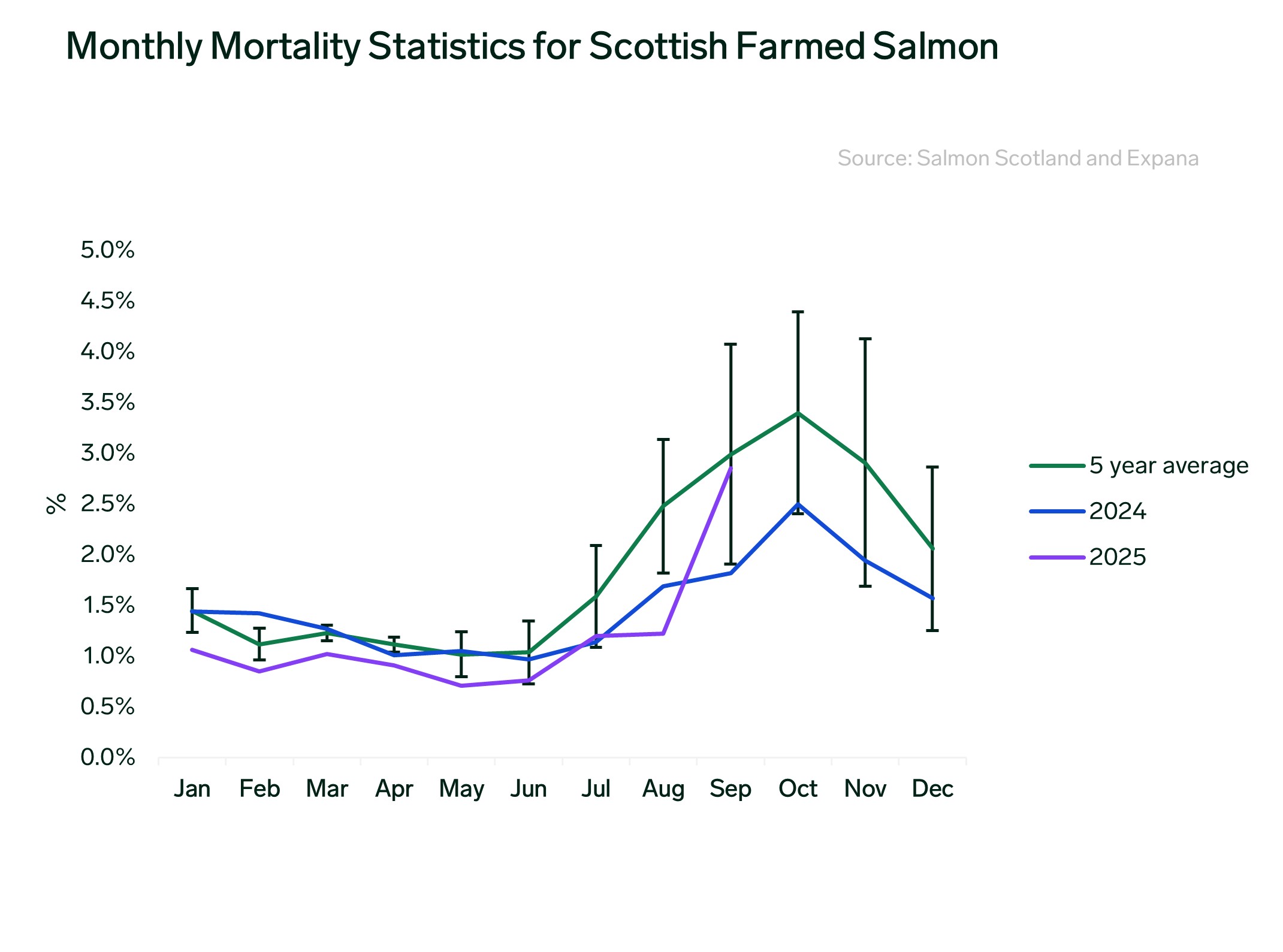

Smolt stocking to sea in 2024 fell by 6.3% compared with 2023. Nevertheless, improved health performance across Scottish sites is expected to support higher total harvest volumes in 2025. As of September 2025, there were 210 active salmon farms, according to a “Salmon Scotland” report published on 28 October 2025. The organisation also reported a monthly mortality rate of 2.85% in September, a sharp increase after seven consecutive months of mortality below both 2024 levels and the five‑year average (except July, which exceeded the 2024 level but remained below the five‑year average) (Figure 2). The main causes of mortality reported in September were gill health issues, bacterial disease, and sea lice.

Figure 2: Monthly mortality (%) represents the percentage of fish lost on each farm every month. Source: Scottish Government’s Fish Health Inspectorate.

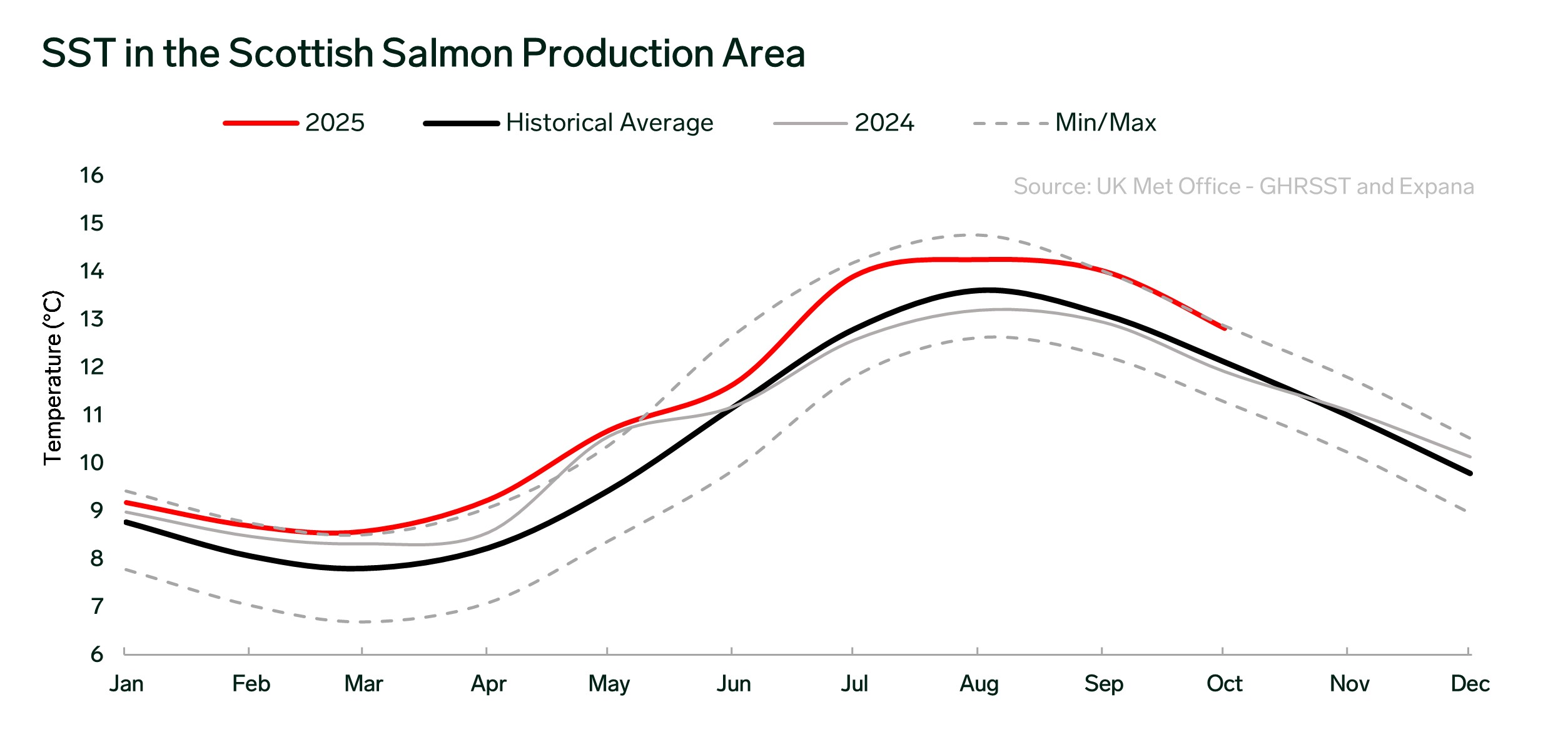

One factor that may contribute to the rise in mortality rates in September is the increase in temperature (Figure 3). According to James Tyler, weather and crop researcher at Expana, this year salmon regions in Scottish waters have experienced consistently warmer monthly average sea surface temperatures (SSTs) in degrees Celsius along the coast of Scotland compared to the 30-year average. For instance, the monthly average SSTs in September were 0.9°C above the 30-year average. The Scottish salmon region has also been consistently warmer in 2025 compared to 2024. This warmer seawater condition may lead to a higher incidence of bacterial diseases and sea lice.

Figure 3: Monthly average of sea surface temperatures (SSTs) in degrees Celsius across the coast of Scotland. Source: UK Met Office – GHRSST Level 4 OSTIA Global Foundation Sea Surface Temperature Analysis.

Scottish Salmon Market

On the market side, Expana Benchmark Prices (EBP) for Scottish salmon (FOB Glasgow, 3–4 kg) have firmed over the past weeks amid limited availability and the influence of a steady-to-firm Norwegian farmed salmon market. Prices rose 9.8% month-on-month and 2.1% week-on-week. In week 45, the EBP for Scottish salmon (3–4 kg, FOB Glasgow) was €7.30/kg (≈ $8.42- £6.40).

Image source: Shutterstock

Written by Boris Ampuero