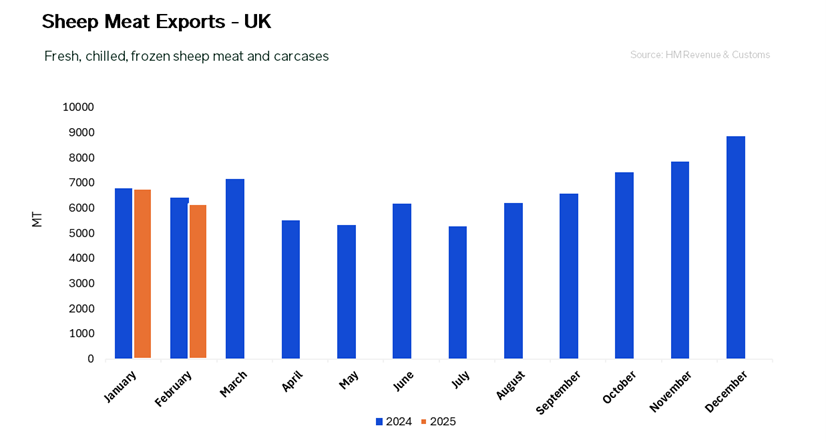

The latest UK sheep meat export figures released by HM Revenue & Customs show that exports for February 2025 are 3.9% lower y-o-y at 6,165 tonnes. The cumulative January to February 2025 sheep meat exports are 2.2% lower than the same period in 2024. In February, the top three export locations (France, Germany, Belgium) represent the majority of the decline, while the Netherlands had a 79% y-o-y increase. Despite export quantities declining in the first two months of February, export value is up and shows that there is good demand even with higher prices. UK lamb market participants reported last week that exports have supported trade volumes and that prices from the Rungis market have held steady during April.

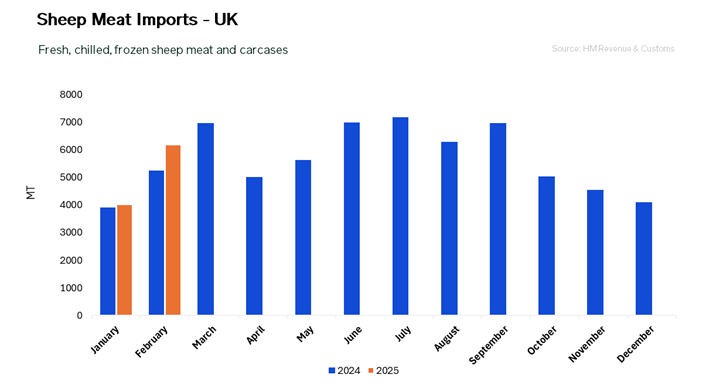

UK imports in February 2025 increased by a significant 18.1% y-o-y with the cumulative Jan-Feb 2025 period reaching an 11.6% increase compared to Jan-Feb 2024. This increase is part of an ongoing long-term trend in which shrinking domestic supply is being replaced by imports abroad. The two key countries competing for the UK lamb market are New Zealand and Australia, respectively increasing by 25.9% and 7.8% y-o-y in February 2025. Ireland also increased its exports to the UK; however its market share has decreased, potentially due to a lack of price competitiveness.

Since the implementation of US tariffs on goods imported from abroad, from a sheep meat perspective, market participants believe the implications on the UK will be minor. The US and UK directly trade negligible amounts of sheep products; therefore, the 10% tariff applied to UK goods will not be impactful. Although, the US is a key import market for sheep meat, the two main suppliers are New Zealand and Australia. According to market sources, the 10% tariff applied to these nations is unlikely to largely disrupt trade flows as sheep meat is a niche product within the US and the prices will remain affordable to consumers, especially due to the price competitiveness of the two countries. It is more likely that the uncertainty around Trump’s tariffs will cause exporters to prioritize alternative trade partners where possible, such as the UK.

The Expana Platform tracks 1256 lamb, sheep and mutton price series across the world. Request a demo today to find out what this data can do for your business.

Image source: Adobe

Written by Luca Curioni