Halloween spending is expected to reach a record $13.1 billion this year, according to the National Retail Federation (NRF). The figure is up from $11.6 billion in 2024 and exceeds the previous record high of $12.2 billion in 2023.

The NRF’s annual survey found that nearly 80% of consumers expect prices to be higher this Halloween because of tariffs. Despite the anticipation of higher prices, a majority of consumers still intend to celebrate, with candy being the most popular purchase. Total spending for candy on Halloween for 2025 is expected to hit $3.9 billion.

While consumer spending on the holiday is likely to reach a record high, market participants state that demand for ingredients to create these candies has been lackluster compared to the previous Halloween’s for a variety of reasons.

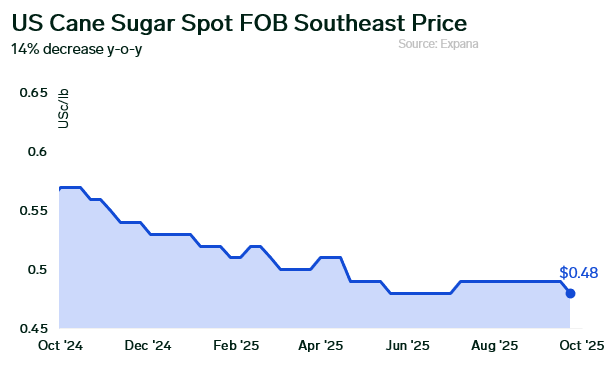

In the sugar market, excess supply has hampered demand. Most end-users are well covered and carried inventory into the new marketing year that began October 1. Large stocks are limiting potential prices gains, while steep tariffs on countries like Brazil support domestic prices. The Expana Benchmark Price for cane sugar spot FOB Southeast (customer access only) was most recently assessed at $0.48/lb, a 14% decrease y-o-y.

Over the last five years, US sugar consumption has been steadily declining, according to USDA reports which also clouds the outlook for sugar demand. As a result, sources tell Expana that preparations for Halloween appear to be weaker compared to last year for chocolate makers. However, many industry players attribute this to challenges in the cocoa market rather than sugar.

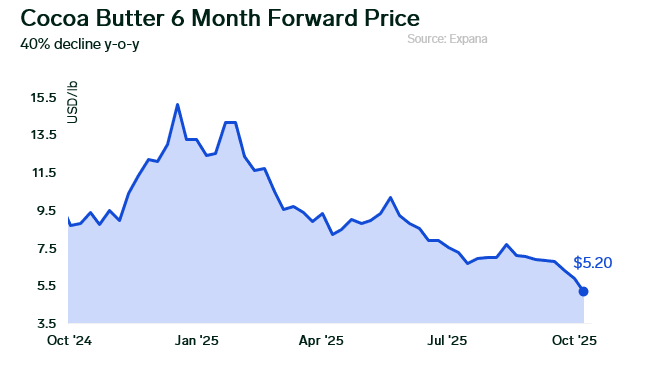

In the cocoa market, extremely high prices in 2024 led to gigantic retail cost increases at the end of last year. Some panic buying ensued to ensure continuity of supply, and many players bought at market highs, particularly chocolate makers. Buyers were locked in with expensive contracts, which flowed through retail and eroded demand to levels by 10-20% lower from 2024 through 2025.

Within the last five years, some players were reformulating for health reasons and stripping sugar out of chocolate bars. The removal of sugar added more cocoa to products, making items pricier. However, most participants pivoted away from this approach as cocoa costs skyrocketed. Several companies opted to reduce pack sizes or value engineer by adding more fruits or nuts to cut costs.

The expensive retail prices stemmed from cocoa supply issues caused by years of structural deficits and unfavorable weather conditions in West Africa. Eventually, there were not enough global stocks available to meet demand. Early buyers extended the rally, but prices have dropped significantly since then. Prices have gone down due to improved crops in West Africa, the world’s largest growing reason, and shifted the supply/demand balance back towards a surplus. The Expana Benchmark Price for cocoa butter (customer access only) was most recently assessed at $5.20/lb, nearly 41% lower compared to a year ago. The high prices of chocolate have also led to an increased use of compound, a chocolate alternative with fat content provided by oils such as coconut oil, combined with cocoa solids from powder. This has been particularly notable in categories such as baked goods.

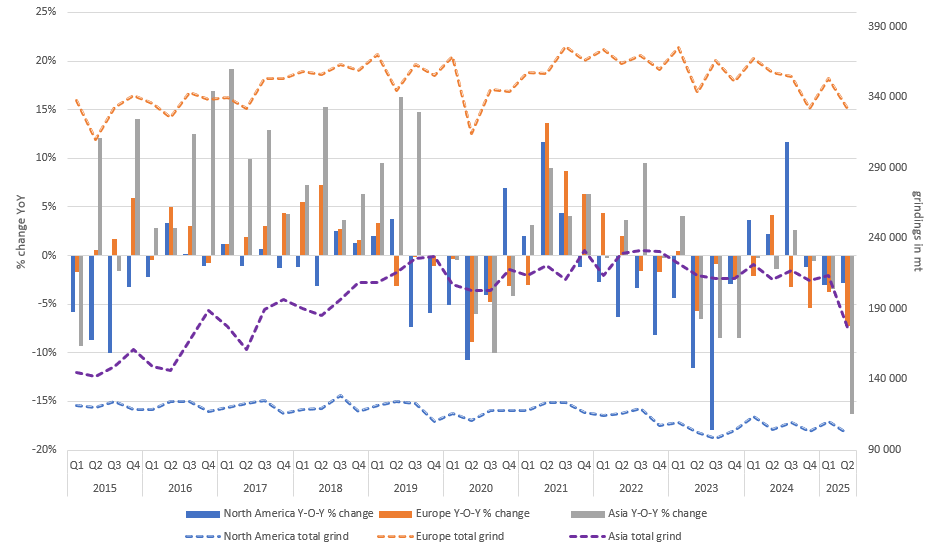

Cocoa grindings, a representation of the amount of cocoa being processed for final consumption, are a good indicator of demand. North American cocoa grind data decreased roughly 3% on the year, as well as Asia, Europe, Malaysia, and Brazil. Cocoa grindings dropped significantly in Asia, declining 16% y-o-y in Q2 this year.

Given expectations for weak Q3 grindings in Europe, Africa, and Asia, this is consistent with the Expana fundamentals team’s estimate of a 3.9% y-o-y decline in grindings for the 2024/25 year which just ended. This represents the largest two-year grindings decline in percentage terms since the 1970s.

Some consumers are concerned about higher shelf prices because of trade uncertainty or supply challenges. The NRF has found that consumers looking to balance budgets for the holiday season have opted to shop early, spread out purchases, or go to discount stores rather than not participate. Nearly 50% of consumers began shopping in September or earlier, a slight increase from 2024. The leading reasons continue to be excitement for the season, a desire not to miss out on desired options, and consumers wanting to avoid the stress of last-minute shopping.

Co-authored by:

Andrew Moriarty

Expana

[email protected]

Image source: Adobe

Written by Andraia Torsiello