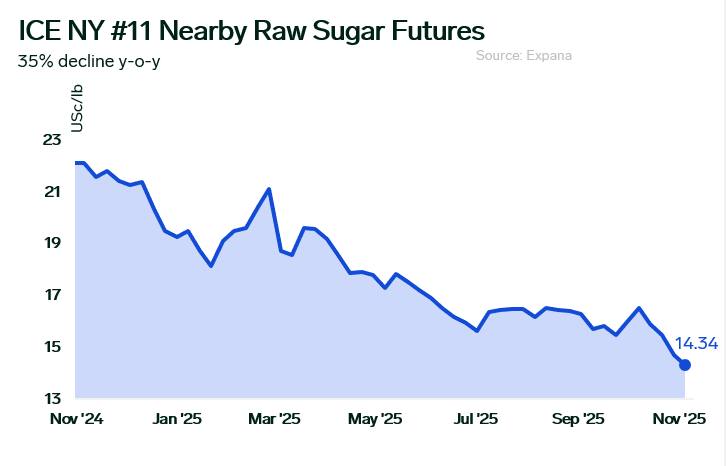

NY #11 nearby raw sugar futures prices have hit a five-year low at 14.34 USc/lb (customer access only). The most recent value is 35% below year ago levels and 13% lower on the month. The decline is primarily driven by a global sugar surplus. The USDA is projecting a record global sugar production of roughly 189 million metric tons for the 2025/26 season, a 4.7% increase y-o-y. The increase in production estimates is based on higher production in Brazil and India, which is expected to offset declines in the European Union.

India, the world’s second-largest sugar producer, are cutting prices after the India Sugar Mill Association raised production estimates last week to 31 million metric tons, almost 19% higher than a year ago. The Association also reduced its estimate for sugar used for ethanol production in India from five million metric tons to 3.4 million metric tons. This reduction could allow India to increase sugar exports this season.

Brazil’s heightened 2025/26 sugar output is also having a bearish impact on prices. Unica reported last week that Brazil’s Center-South sugar output increased 1.3% y-o-y during the first half of October, totaling 2.48 million metric tons. Additionally, the percentage of sugarcane crushed for sugar in October rose to 48%, a slight increase from last year.

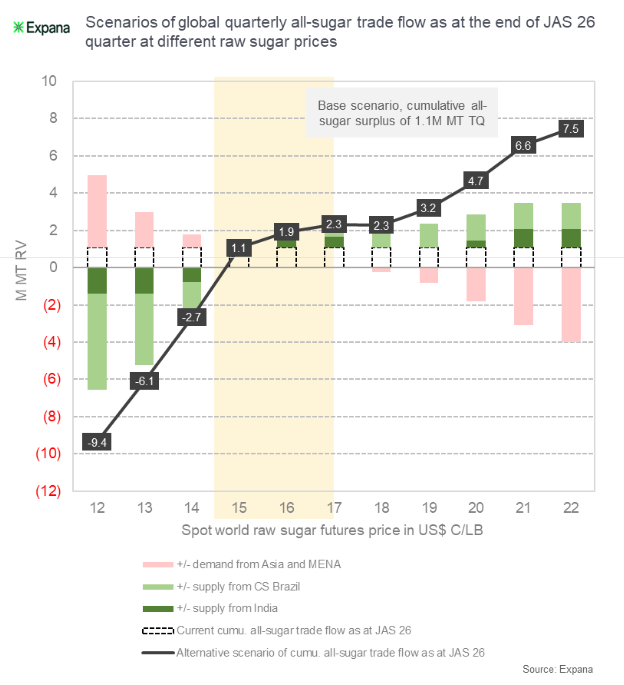

Expana’s latest global sugar S&D balance sheet shows a surplus of 3.2 million metric tons, raw value in the 2025/26 marketing year. This is a 1.2 million metric tons, raw value increase from the previous update. Larger increases in production estimates will offset rises in consumption projections.

The cumulative trade flow for the 2025/26 marketing year has tightened slightly from previous updates but still shows a surplus. Major supply changes for 2025/26 occurred in Center-South Brazil, where a portion of Q4 2025 sugar exports were moved forward to Q3. Also, part of Q3 2026 exports were rolled to the following quarter in response to the current market price structure and loading capacity adjustments.

Some market participants state there is a slightly bullish undertone globally, as current prices have hit such low levels. However, there is limited upside price potential for world raw sugar futures and domestic sugar on the spot market as there is excess supply available, according to industry feedback.

Image source: Shutterstock

Written by Andraia Torsiello